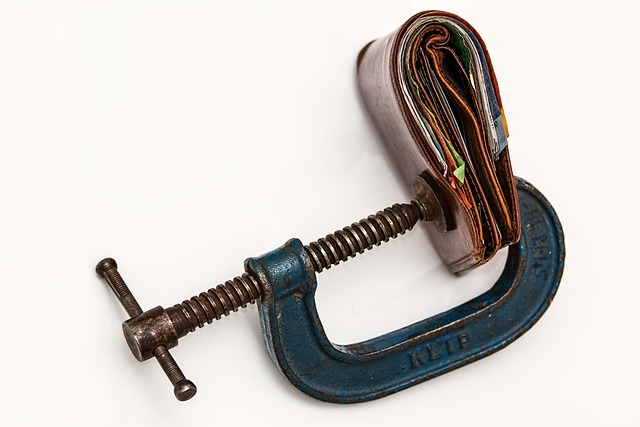

Credit card debt consolidation offers a strategic solution for seniors and individuals burdened by high-interest rates. By combining multiple high-interest cards into a single loan with a lower rate, it simplifies financial management and streamlines repayment. Evaluating your financial situation, prioritizing high-interest rates, and considering potential drawbacks are crucial steps. Crafting a debt management plan that combines budgeting techniques with consolidation strategies can lead to swift debt reduction and long-term financial stability. Seniors have options like consolidation loans and debt management plans facilitated by counselors, enabling them to consolidate credit card debt fast while ensuring financial health.

Struggling with high-interest credit card debt? Reliable Strategies for Consolidating Credit Card Debt offers a comprehensive guide to help you take control. This article dives into various aspects of credit card debt consolidation, including understanding your financial situation, exploring loan options like debt consolidation loans (with pros and cons), crafting a strategic plan for rapid reduction, tailored strategies for seniors, and the long-term benefits of breaking free from debt once and for all.

- Understanding Credit Card Debt Consolidation: A Comprehensive Guide

- Evaluating Your Financial Situation for Effective Debt Management

- Exploring Debt Consolidation Loans: Pros and Cons

- Crafting a Strategic Plan for Rapid Credit Card Debt Reduction

- Senior Citizens and Credit Card Debt Relief: Tailored Strategies

- Long-term Benefits of Credit Card Debt Consolidation: Breaking Free from Debt

Understanding Credit Card Debt Consolidation: A Comprehensive Guide

Credit card debt consolidation is a strategic approach designed to simplify and reduce the financial burden of multiple credit card debts. It involves combining several high-interest credit card balances into a single, more manageable loan with a potentially lower interest rate. This strategy offers significant advantages for seniors and individuals grappling with high-interest credit card debt relief. By consolidating, borrowers can say goodbye to numerous payment due dates and complex budgeting routines, making financial management easier and more efficient.

Debt management plans for credit cards play a pivotal role in this process. These plans typically involve transferring the existing balances to a new loan with a lower interest rate, which can be achieved through various methods like credit card debt consolidation loans. The goal is to pay off the debt faster while saving on interest expenses. Seniors and others looking to consolidate credit card debt fast should explore these options to gain control over their finances, reduce stress, and ultimately achieve financial stability.

Evaluating Your Financial Situation for Effective Debt Management

Evaluating your financial situation is a crucial step in managing and consolidating credit card debt, especially for seniors looking to find relief from high-interest rates. The first step is to gather all your financial information, including income statements, expenses, and details of your existing credit card debts. Understanding your monthly cash flow and obligations is essential to creating a realistic debt management plan.

By analyzing your spending patterns and identifying areas where you can cut back, you can free up additional funds for debt repayment. Many seniors discover hidden expenses or unnecessary costs that, when reduced, provide much-needed financial breathing space. This process also involves assessing the terms of your credit card agreements, including interest rates and any associated fees, to determine which debts require immediate attention. Credit card debt consolidation loans, specifically designed to reduce high-interest credit card debt, can be a game-changer for those seeking fast relief.

Exploring Debt Consolidation Loans: Pros and Cons

Debt consolidation loans are a popular strategy for those looking to escape the burden of high-interest credit card debt. These loans allow individuals to combine multiple credit card balances into one, often with a lower interest rate. This simple restructuring can significantly reduce monthly payments and provide much-needed financial relief. For seniors carrying substantial credit card debt, this approach offers a chance to simplify their finances and avoid the potential pitfalls of high-interest charges.

However, it’s crucial to consider both the advantages and potential drawbacks. Pros include reduced interest costs and easier management of a single loan versus several cards. Consolidation can also speed up debt repayment by focusing all efforts on one payment. Yet, there are cons to bear in mind. Taking out a loan means adding another financial obligation, and if not managed carefully, it could lead to further debt issues. Additionally, not all consolidation loans are created equal; some may come with hidden fees or variable interest rates that can make the situation worse, especially for those looking for fast credit card debt consolidation. It’s essential to compare options and seek professional advice to create a sustainable debt management plan for credit cards, ensuring long-term financial health.

Crafting a Strategic Plan for Rapid Credit Card Debt Reduction

Crafting a strategic plan is key to rapidly reducing credit card debt, especially for seniors looking to alleviate high-interest debt burdens. The first step involves evaluating your current financial situation by listing all outstanding credit card balances and their associated interest rates. Prioritize paying off cards with the highest rates first while making minimum payments on others to avoid penalties. This approach maximizes savings on interest charges.

Consider a debt management plan that combines budgeting techniques with consolidation strategies, such as applying for a low-interest consolidation loan. Such loans bundle multiple credit card debts into one, simplifying repayment and potentially reducing monthly outgoings. Remember that while consolidating offers relief from high-interest rates, it’s crucial to maintain discipline in managing spending and adhering to the agreed-upon repayment plan to achieve lasting credit card debt relief.

Senior Citizens and Credit Card Debt Relief: Tailored Strategies

For many senior citizens grappling with high-interest credit card debt, finding effective relief can seem like a daunting task. However, there are tailored strategies designed to help this demographic manage and consolidate their debt. One popular approach is through credit card debt consolidation loans, which offer lower interest rates and more manageable monthly payments. These loans allow seniors to combine multiple credit card balances into one, simplifying their financial obligations.

Debt management plans for credit cards are another valuable tool. These plans involve working with a debt counselor who creates a budget-friendly repayment schedule. By negotiating with creditors, the counselor can lower interest rates and set up affordable payments, making it easier for seniors to reclaim control of their finances. This method focuses on long-term debt relief rather than quick fixes, ensuring that senior citizens can consolidate their credit card debt fast while maintaining a sustainable financial future.

Long-term Benefits of Credit Card Debt Consolidation: Breaking Free from Debt

Credit Card Debt Consolidation offers more than just a temporary fix; it’s a powerful tool for achieving long-term financial freedom. By combining multiple high-interest credit card debts into a single, more manageable loan with a lower interest rate, individuals can break free from the cycle of constant payments and accruing debt. This strategic move provides several significant advantages.

Firstly, it simplifies repayment by consolidating the debt over a longer period, making it easier to budget and ultimately pay off the balance. Secondly, lower interest rates mean less money spent on interest charges over time, which is especially beneficial for seniors or anyone with substantial credit card debt. Additionally, a Debt Management Plan tailored to credit card debt consolidation can help individuals gain control of their finances, improve credit scores, and achieve financial stability, ensuring a brighter future free from the burden of high-interest credit card debt.

Credit card debt consolidation offers a viable path to financial freedom, especially with strategic planning and tailored approaches like those designed for senior citizens. By evaluating your financial situation, exploring loan options (including the pros and cons), and adopting a rapid debt reduction strategy, you can break free from high-interest credit card debt. Remember that consolidating credit card debt is a significant step towards long-term financial health and stability.