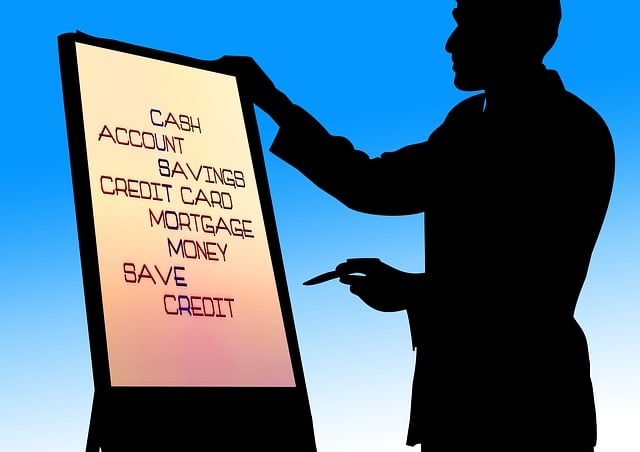

Credit card debt consolidation is a powerful tool for seniors to overcome high-interest debt by combining multiple cards into one loan with a lower rate, simplifying repayment and saving on interest. Tailored debt management plans negotiate lower rates and create affordable schedules, offering both short-term relief and long-term financial stability. Options range from fast-track methods like lump-sum payments to secured loans requiring collateral, with the ideal choice depending on individual circumstances and risk tolerance. Evaluating one's financial situation is crucial before selecting a strategy that considers interest rates, fees, and credit scores.

Struggling with credit card debt? You’re not alone. Many find themselves overwhelmed by high-interest payments and mounting balances. But there’s hope! This comprehensive guide explores various debt relief options tailored to your needs, including credit card debt consolidation strategies for seniors, quick fixes for high-interest debt, and step-by-step approaches to managing credit card debt effectively. Discover how to consolidate fast with loans or navigate a debt management plan, empowering you to take control of your financial future.

- Understanding Credit Card Debt Consolidation: A Comprehensive Guide

- Benefits of Credit Card Debt Consolidation for Seniors

- High-Interest Credit Card Debt Relief Strategies: Quick Fixes and Long-Term Solutions

- Exploring Debt Management Plans: A Step-by-Step Approach to Credit Card Debt Relief

- Fast Track Credit Card Debt Consolidation: Loans and Their Pros & Cons

- Navigating Credit Card Debt Relief: A Comprehensive Comparison

Understanding Credit Card Debt Consolidation: A Comprehensive Guide

Many seniors find themselves burdened by high-interest credit card debt, but understanding credit card debt consolidation can offer a much-needed relief pathway. This process involves combining multiple credit card debts into a single loan with a lower interest rate, simplifying repayment and potentially saving money on overall interest charges. It’s particularly beneficial for those struggling to keep up with the constant snowball effect of multiple due dates and varying rates.

Credit card debt consolidation loans are designed to provide a fast track to financial stability. By consolidating debt, seniors can bid farewell to the stress of multiple payments and unpredictable rate hikes. Moreover, a debt management plan specifically tailored for credit cards can offer structured repayment options, allowing individuals to regain control over their finances. This approach is especially valuable in navigating the complexities of high-interest credit card debt relief while ensuring a comprehensive solution that aligns with one’s financial goals.

Benefits of Credit Card Debt Consolidation for Seniors

Credit Card Debt Consolidation can be a powerful tool for seniors looking to gain control over their finances and high-interest credit card debt. By consolidating their credit card debt, seniors can simplify their repayment process and potentially lower their overall interest rates. This strategy allows them to manage their debt more effectively, especially as interest charges on unpaid balances can accumulate quickly.

It offers a structured approach through Debt Management Plans, where seniors can work with a dedicated provider to create a personalized strategy. Consolidation loans can also provide a fast track to debt reduction, enabling seniors to consolidate multiple credit card debts into one manageable loan. This streamlines repayment and can free up disposable income, offering much-needed financial relief and peace of mind.

High-Interest Credit Card Debt Relief Strategies: Quick Fixes and Long-Term Solutions

Many people find themselves burdened by high-interest credit card debt, but there are effective strategies to ease this financial strain. One popular approach is credit card debt consolidation, where multiple cards with varying interest rates are combined into a single loan with a lower, fixed rate. This quick fix allows for easier repayment management and significant savings on interest payments over time. For seniors or individuals with limited income, specialized programs offer credit card debt consolidation for seniors, providing tailored solutions to navigate financial challenges responsibly.

Beyond consolidation, debt management plans for credit cards can be a long-term solution. These plans involve working closely with creditors to negotiate lower interest rates and set up affordable repayment schedules. Fast-track consolidation options are also available, allowing borrowers to quickly reduce debt through a lump-sum payment or aggressive repayment strategies. Credit card debt consolidation loans and other financial tools can empower individuals to take control of their finances and move towards a debt-free future.

Exploring Debt Management Plans: A Step-by-Step Approach to Credit Card Debt Relief

Many individuals struggling with credit card debt find themselves in a complex web of high-interest rates and recurring fees. Exploring debt management plans can provide a much-needed lifeline, offering a structured approach to tackling this financial challenge. These plans are specifically designed to help manage and reduce outstanding credit card debt efficiently.

The first step towards relief involves evaluating your current financial situation. List all your credit cards, the balances, and the associated interest rates. Then, consider your income, fixed expenses, and any other debts you owe. Once this assessment is complete, a debt management plan can be tailored to your needs. This typically involves consolidating your credit card debt into a single loan with a lower interest rate, making repayment more manageable. For seniors or anyone looking for fast relief, credit card debt consolidation loans are an attractive option. By combining multiple cards into one, you simplify payments and potentially save on interest. This step-by-step approach not only provides much-needed breathing space but also paves the way for long-term financial stability.

Fast Track Credit Card Debt Consolidation: Loans and Their Pros & Cons

Many seniors struggling with high-interest credit card debt find themselves in a bind, but there’s a light at the end of the tunnel through Credit Card Debt Consolidation. This process involves combining multiple high-interest debts into one loan with a lower interest rate, providing much-needed relief for those burdened by mounting bills. One popular method is consolidating credit card debt fast using a secured loan or line of credit, which uses an asset as collateral to secure the new, consolidated loan.

The pros of this approach are evident: lower monthly payments, reduced interest expenses, and the potential to pay off the debt faster. However, there are also cons to consider. Secured loans require an asset as collateral, meaning there’s a risk of losing that asset if the borrower defaults. Additionally, these loans often have fixed interest rates, eliminating the benefits of future interest rate drops. Debt management plans for credit cards offer a more flexible alternative, allowing borrowers to create a repayment plan tailored to their income and expenses without needing collateral.

Navigating Credit Card Debt Relief: A Comprehensive Comparison

Navigating credit card debt relief options is a crucial step for many individuals burdened by high-interest rates and mounting balances. One popular strategy is credit card debt consolidation, where multiple cards are combined into a single loan with a lower interest rate, making payments more manageable. This approach can be particularly beneficial for seniors looking to simplify their financial obligations; consolidating debt allows them to focus on one fixed payment rather than several variable ones.

Several methods exist for achieving credit card debt consolidation, including debt management plans (DMPs). These plans, often facilitated by non-profit credit counseling agencies, help individuals negotiate with creditors for lower rates and tailored repayment schedules. For those seeking a quicker solution, credit card debt consolidation loans offer a direct path to paying off balances. While these options have their advantages, it’s essential to consider factors like interest rates, fees, and potential impacts on credit scores before making a decision.

Despite the challenges posed by credit card debt, there are numerous options available to help individuals regain financial control. From traditional consolidation loans to innovative debt management plans, each strategy offers a unique path to relief. For seniors and those burdened by high-interest rates, specialized approaches provide tailored solutions. By exploring these various methods, individuals can make informed decisions to consolidate credit card debt fast and navigate their financial future with renewed confidence. Remember, seeking professional guidance is essential when considering any credit card debt consolidation options.