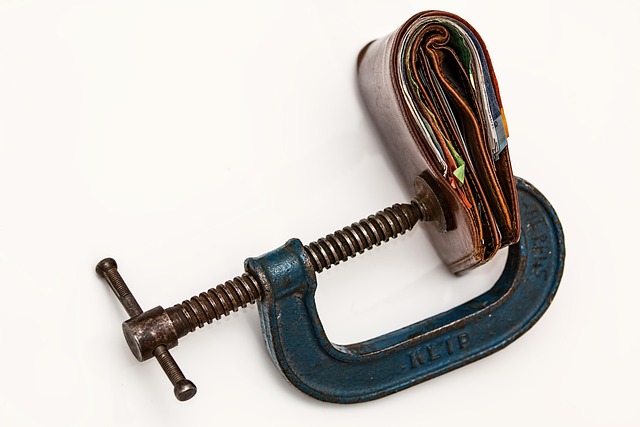

Struggling with high-interest credit card debt? Credit card debt consolidation offers a strategic solution for seniors or individuals burdened by multiple debts. There are two primary methods: debt management plans that negotiate better terms with creditors and consolidation loans that allow borrowing a larger sum to pay off debts faster. Both options simplify repayment, reduce stress, and lead to quicker debt reduction, providing significant relief from high-interest credit card debt.

Struggling with high-interest credit card debt? There’s hope. This guide explores relief options tailored for those facing overwhelming credit card debt, focusing on strategies like consolidation and debt management plans. For seniors or anyone seeking swift solutions, understanding fast consolidation loans can be a game-changer. Learn how to navigate these options, reduce interest rates, and regain control of your finances.

- Understanding Credit Card Debt Consolidation Options

- Strategies for Rapid and Effective High-Interest Credit Card Debt Relief

Understanding Credit Card Debt Consolidation Options

Credit card debt consolidation is a strategic approach to managing and reducing high-interest credit card debt. It involves combining multiple credit card debts into one loan with a potentially lower interest rate, making it easier to manage repayments. For seniors or individuals with substantial credit card debt, this option can provide much-needed relief. By consolidating, you can simplify your financial obligations and make payments more affordable without the burden of multiple due dates and varying interest rates.

There are various methods to achieve credit card debt consolidation, including debt management plans and loans specifically designed for this purpose. Debt management plans help by negotiating with creditors to lower interest rates and fees, creating a structured repayment schedule tailored to your budget. Alternatively, consolidation loans allow you to borrow a larger sum to pay off your debts, focusing on lowering the overall interest charged over time. Both options offer quicker debt reduction and can significantly ease the stress associated with high-interest credit card debt.

Strategies for Rapid and Effective High-Interest Credit Card Debt Relief

Struggling with high-interest credit card debt? There are several strategies to swiftly and effectively ease this financial burden. One popular approach is credit card debt consolidation, where multiple cards are combined into a single loan with a lower interest rate, making repayment more manageable. This method is especially beneficial for seniors looking to simplify their financial obligations.

Another effective strategy involves creating a debt management plan. This involves working closely with a credit counseling agency to negotiate reduced interest rates and set up a structured repayment schedule tailored to your budget. Fast consolidation options are also available, allowing you to quickly reduce debt through loans specifically designed for this purpose. By exploring these avenues, individuals can take control of their financial future and bid farewell to high-interest credit card debt once and for all.

If you’re struggling with high-interest credit card debt, it’s time to explore relief options. Credit card debt consolidation can provide a clear path to financial freedom by combining multiple cards into a single loan with a lower interest rate. For seniors and others seeking fast solutions, debt management plans offer structured repayment strategies tailored to individual needs. Consolidate credit card debt quickly and efficiently with these proven methods, reclaiming control over your finances and securing a brighter financial future.